Don’t hesitate to get back to me if you have other questions while working with payroll transactions. Allow me to bring clarifications with your concern what is the journal entry to record the issuance of common stock about handling payroll transactions in QuickBooks Online (QBO). Enter the username and password you use to log in to your online banking account.

Add taxes paid towards 941 or 944 taxes

Adjusting employer contribution parameters, such as retirement plans or health benefits, should be carefully assessed to align with company policies and employee benefits. QuickBooks Online provides user-friendly options for these adjustments, allowing businesses to customize their payroll settings efficiently. It is critical to consider the implications of these changes, including potential impacts on employee paychecks, tax filings, and financial reporting. Users can access the Pay Liabilities feature to calculate taxes accurately, including federal and state payroll taxes. QuickBooks Desktop provides support for a variety of tax forms, making it easier to stay compliant with tax regulations. The system allows for electronic payment processing, further simplifying the settlement of liabilities.

Step 4: Print Reports From Your QuickBooks Payroll Software & General Ledger

In our example above, the ending balance in the payroll liabilities account for the period is $50. You’ll see a list of transactions in the account, but if it includes too much data, or not enough, you can adjust the dates the report covers by selecting the box on the left of the report date. Here, you can choose to have the report cover data from the last 30 days, 90 days, and even the entire year. You should also enter data for the report in the box on the right—the current date should suffice.

How do I manually enter employer payroll liabilities into Quickbooks online?

Now let’s move on to making changes to the payroll tax liabilities in QuickBooks, but before that ensure you have the latest payroll tax table updates installed. While reviewing your payroll, make sure that you check the net pay and both the employer and employee tax amounts for reasonableness. Once this is completed, the adjusted figures need to be accurately entered into the payroll system to ensure that all liabilities are properly accounted for and reflect the changes that have been made. Then the net pay comes out and matches exactly what comes out of the bank account. There are two ways to manually enter payroll in QuickBooks Online if your payroll software product doesn’t integrate with it.

- Proper management of payroll liabilities streamlines tax reporting and ensures timely payments.

- Which method you choose will depend on how much detail you want in your payroll reports within QuickBooks Online.

- See articles customized for your product and join our large community of QuickBooks users.

- If you are just signing up for QuickBooks Payroll, the system will ask you a few questions, such as if you require HR support and need to track employee work hours.

How to Watch Movies With Friends Online Easily for Free

Payroll is the most time-consuming accounting task, and you need the right tools to work efficiently. Automate the payroll process so you can save time and focus on growing your business. When you submit payments, you also provide reports that explain the purpose of the payments (employee name, amounts withheld, etc.). Your company’s payroll- liabilities chart of accounts may include dozens of balance-sheet account numbers.

By following these seven simple steps, you can get your account set up and your payroll processed in just a few minutes. QuickBooks Online users don’t need to search for another provider to find the right payroll solution for their business. You can easily set up payroll within the platform, plus you are granted access to full-service pay processing solutions, including health insurance and benefits options for your workforce. In this comprehensive guide, we will explore how to adjust payroll liabilities in QuickBooks, QuickBooks Online, and QuickBooks Desktop. From identifying the need for adjustment to making necessary changes in payroll setup and reconciling liabilities, we will cover the essential steps and best practices for each scenario.

If you don’t see yours listed, enter it in the search box, where “Bank of America” is shown below. Below is a screenshot, along with a brief explanation of the required information for federal taxes. Another useful setting QuickBooks Payroll implements is setting your tax rates to the default percentages based on the most current information released by federal and state tax agencies. Hawkins Ash CPAs uses an external secure online pay platform for accepting payments. While these questions will help match you with the right plan, you also have the option to manually select one of its three payroll options yourself. QuickBooks will recommend the best payroll plan for you, and you can even sign up for a 30-day free trial.

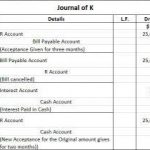

You can access it from the same system you use to manage your business’ books, allowing for the seamless transfer of your payroll expenses to the appropriate general ledger accounts. This reconciliation ensures that the revised liabilities are accurately entered into QuickBooks Online, maintaining the integrity of the payroll system and financial compliance. When you record the paychecks in the Payroll Clearing account, you still book the gross pay and the withholding. When all of the paychecks are in, that negative amount should be exactly equal to the amount of the net pay that comes out of the bank account. When that transaction is posted in the bank account, book it to the Payroll Clearing.

The steps shared by Klent are also applicable for payments made via phone calls. You can enter a short description in the Memo column of what the entries are for. Hello Klent, Because our Payroll System was what is an enrolled agent for taxes down when quarterly Payroll Tax was due, I paid the liability via telephone. If I follow the above instructions and change the liability amount in Payroll, how will I enter the payments made by phone??

Any funds that aren’t routinely cleared from your payroll accounts, like retirement benefit premiums that are paid out monthly, indicate there may be a problem. For instance, a bill payment may be late, or a historical cost definition transaction could be booked to the wrong account(s). On the other hand, QuickBooks Desktop presents a different set of payment methods, including traditional check printing and manual payment processing.

These variations impact the overall experience and efficiency of payroll liability management. Implementing scheduled liabilities payments in QuickBooks Desktop streamlines tax filing processes and compliance adherence by automating the timely allocation of funds towards payroll liabilities. With detailed reporting capabilities, businesses can track and verify the accuracy of their tax payments, enhancing overall financial management and accountability.