(NEXSTAR) Regarding the slide of 2021, people Services Mortgage Forgiveness Program was overhauled because of the Biden government. Since then, several thousand consumers have received $8.1 mil in scholar debt settlement.

The public Provider Loan Forgiveness system, otherwise PSLF, was developed inside the 2007 toward aim of permitting group that have nonprofit and you will government businesses of the flexible the figuratively speaking immediately after ten numerous years of payments (120 total payments). The entire recognition rate one of applicants has been reduced merely 1 in 5 of the 1.step three mil individuals searching for personal debt launch due to PSLF was on track to see recovery because of the 2026, based on research in the Arizona Post.

Within the 2021, the new You.S. Service out of Education announced a distinction you to briefly waives particular PSLF standards to offer individuals borrowing towards the mortgage termination aside from the government loan types of or if that they had come subscribed to good particular commission bundle, as long as they consolidated the loans through to the stop regarding the fresh new waiver.

Through to the waiver, consumers needed seriously to keeps a certain federal mortgage a primary Financing in order to be eligible for PSLF. Consumers you certainly will combine its obligations for the Lead Financing to have PSLF, but one repayments produced on the loans prior to integration don’t matter towards the required tally.

That it waiver is currently set to expire immediately after , meaning qualified consumers simply have in the five days left to apply. Richard Cordray, your face regarding Government College student Support, told you at a conference the 2009 week you to as he are pushing on PSLF waiver to-be stretched, President Biden can get lack the administrator power in order to accept such as for instance a good circulate.

PSLF certificates

A recent declaration throughout the Scholar Borrower Security Cardiovascular system discover more 9 million public service pros probably qualify for debt cancellation thanks to the fresh new PSLF program, but i have yet , to help you file new papers to start the procedure. California, Colorado, Florida, and you may Nyc have the really public service experts with beginner mortgage loans, considering SBPC.

Once the said more than, PSLF is meant to bring qualified public-service personnel loans forgiveness shortly after an appartment number of payments are designed.

- Be employed by an effective You.S. federal, state, regional or tribal authorities or otherwise not-for-funds providers (government solution includes You.S. military solution)

- Works full-time for that company otherwise company

- Keeps Lead Money (or consolidate most other federal student education loans for the an immediate Mortgage)

- Build 120 qualifying payments

Within the most recent PSLF waiver, qualified consumers can be receive borrowing from the bank to have repayments generated to the other mortgage products, significantly less than one commission bundle, in advance of integration otherwise adopting the deadline. People that received Professor Financing Forgiveness can use the period away from service that contributed to the qualification towards the PSLF, if they can approve PSLF work for the months.

Just how to know if your qualify

Step one during the choosing the qualifications is actually going to the FSA’s webpages and signing in the account. You are able to look your boss for the FSA’s databases and you will create factual statements about your a career. Once you discover your boss, you are able to determine whether they qualifies below PSLF.

Second, centered on SBPC’s walkthrough publication, you ought to decide which kind of government student loans your keeps. Lead Finance meet the requirements to have PSLF if you are almost every other fund need certainly to be consolidated into the a primary Integration Mortgage. Until the stop out-of , previous being qualified repayments you have made with the a low-Lead Loan have a tendency to amount for the requisite 120 repayments PSLF needs for forgiveness.

After you have finished the fresh new procedures above, you’ll need to show the work. You really need to then have the ability to fill in the PSLF form.

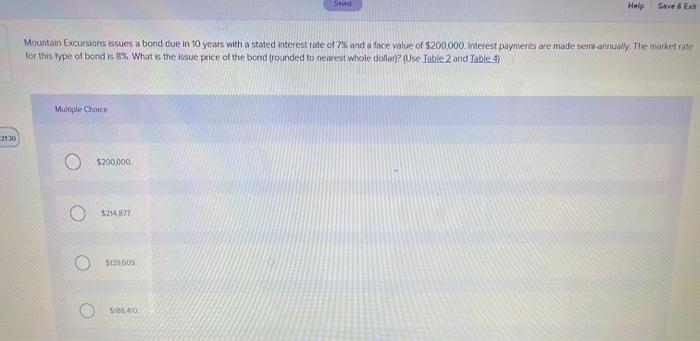

Whom qualifies with the currently-approved education loan forgiveness?

When you’re extensive student loan forgiveness hasn’t but really be realized, specific U.S. borrowers have obtained particular credit card debt relief. About step one.3 million individuals have observed $twenty-six billion within the pupil loans forgiveness while the President Biden got place of work.

Also the several thousand consumers which have received financial obligation termination according to the revamped PSLF system, some other 690,100000 consumers have experienced a total of $eight.nine million in student education loans deleted through discharges on account of debtor security and college or university closures. Over eight hundred,000 borrowers https://paydayloanalabama.com/york/ have obtained over $8.5 million with debt forgiveness using total and permanent disability release.

Last day, the Biden management wanted to cancel $6 mil during the federal student obligations for around two hundred,000 individuals as part of a recommended category-action payment. The borrowers allege their college or university defrauded her or him in addition to their software to own respite from the newest Agencies regarding Education were delay for a long time.